A8A In-Bond Cargo Control Document (Customs Glossary): Difference between revisions

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

{{note|This article is part of the [[Customs_Glossary_Guide|Customs Glossary Guide]]|info}} | {{note|This article is part of the [[Customs_Glossary_Guide|Customs Glossary Guide]]|info}} | ||

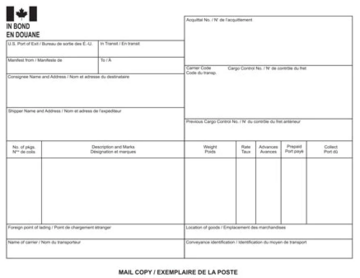

[[Image:A8a-in-bond-cargo-control-document.png|360px|right|thumb|An A8A In-Bond Cargo Control Document as seen from BorderPrint.com]]The '''A8A In-Bond Cargo Control Document''' is a critical form used in Canada for the transportation and control of in-bond merchandise. In-bond merchandise refers to goods that are passing through Canada to a foreign destination and are not intended for consumption or use within the country. The A8A form is utilized by carriers, freight forwarders, and bonded warehouses to account for the movement of in-bond merchandise under the supervision of the Canada Border Services Agency (CBSA). This article provides an overview of the A8A In-Bond Cargo Control Document and the scenarios in which it is used. | [[Image:A8a-in-bond-cargo-control-document.png|360px|right|thumb|An A8A In-Bond Cargo Control Document as seen from BorderPrint.com]]The '''A8A In-Bond Cargo Control Document''' is a critical form used in Canada for the transportation and control of in-bond merchandise. In-bond merchandise refers to goods that are passing through Canada to a foreign destination and are not intended for consumption or use within the country. The A8A form is utilized by carriers, freight forwarders, and bonded warehouses to account for the movement of in-bond merchandise under the supervision of the Canada Border Services Agency (CBSA). This article provides an overview of the A8A In-Bond Cargo Control Document and the scenarios in which it is used. | ||

Latest revision as of 11:48, 1 August 2023

| This article is part of the Customs Glossary Guide |

The A8A In-Bond Cargo Control Document is a critical form used in Canada for the transportation and control of in-bond merchandise. In-bond merchandise refers to goods that are passing through Canada to a foreign destination and are not intended for consumption or use within the country. The A8A form is utilized by carriers, freight forwarders, and bonded warehouses to account for the movement of in-bond merchandise under the supervision of the Canada Border Services Agency (CBSA). This article provides an overview of the A8A In-Bond Cargo Control Document and the scenarios in which it is used.

The A8A In-Bond Cargo Control Document is an official document regulated by the CBSA in Canada. It plays a crucial role in facilitating the movement of in-bond merchandise through Canadian territory without subjecting it to import duties or taxes. The form serves as a comprehensive record of the merchandise's origin, intended destination, transporting carrier, and other essential information.

Scenarios in Which the A8A In-Bond Cargo Control Document is Used:

Transit Shipments:

Goods are transported through Canada to a foreign country, and their final destination is not within Canada's borders. Use of A8A: The A8A form is employed to authorize the in-bond movement of the goods through Canada to their foreign destination without the need for formal entry or payment of import duties.

Temporary Importation:

Scenario: Goods enter Canada temporarily for further manufacturing or processing and are eventually re-exported. Use of A8A: The A8A form allows for the temporary importation of the goods for processing while ensuring their re-exportation once the transformation is completed.

Goods Transported to Border Customs Control Zones:

Scenario: Goods arrive at a border customs control zone in Canada, and they are intended to be exported without entering the Canadian market. Use of A8A: The A8A form ensures the goods remain under CBSA supervision in the border zone until they are ready for exportation.

Conclusion

The A8A In-Bond Cargo Control Document is a vital instrument used by the Canada Border Services Agency to regulate the movement of in-bond merchandise through Canadian territory. It facilitates the efficient transportation of goods to foreign destinations without subjecting them to import duties or taxes within Canada. By adhering to the proper procedures and utilizing the A8A form correctly, carriers, freight forwarders, and bonded warehouses can ensure a smooth in-bond movement, compliance with CBSA regulations, and the seamless movement of goods in international trade.