ATA Carnet (CBP CBSA): Difference between revisions

No edit summary |

|||

| Line 115: | Line 115: | ||

* The carnet must accompany the goods | * The carnet must accompany the goods | ||

{{ | {{tip| | ||

A paper '''A8A''' is '''not''' a standard requirement for ATA Carnet processing. | A paper '''A8A''' is '''not''' a standard requirement for ATA Carnet processing. | ||

A8A documents are associated with '''in-bond movements''' only. | A8A documents are associated with '''in-bond movements''' only. | ||

| Line 124: | Line 124: | ||

<ref name="cbsa-d8-1-7" /> | <ref name="cbsa-d8-1-7" /> | ||

{{ | {{warning| | ||

ACI/eManifest highway cargo and conveyance data must generally be received and validated by CBSA at least '''one (1) hour prior to arrival''' at the First Port of Arrival (FPOA). | ACI/eManifest highway cargo and conveyance data must generally be received and validated by CBSA at least '''one (1) hour prior to arrival''' at the First Port of Arrival (FPOA). | ||

}} | }} | ||

Latest revision as of 15:58, 22 January 2026

|

🔖 This article is part of the Shipment Release Types Guide |

An ATA Carnet is an international customs document used to simplify the temporary admission (temporary import/export) of eligible goods across borders.

In Canada, an ATA Carnet serves as an alternative to documenting temporary importations on form E29B (Temporary Admission Permit) and acts as a financial guarantee for duties and taxes if the goods are not re-exported within the authorized time limits.

What Goods Can Be Covered by an ATA Carnet

ATA Carnets are typically used for goods that will enter a country temporarily and then be exported again in the same condition.

| Eligible Goods | Common Examples |

|---|---|

| Commercial Samples | Product samples for sales demonstrations |

| Professional Equipment | Tools, instruments, cameras, broadcasting equipment |

| Exhibitions & Fairs | Trade show displays, exhibits, display materials |

Goods That Are NOT Eligible

Carnets generally cannot be used for goods that are intended to remain in the country or be altered.

| Not Eligible | Examples |

|---|---|

| Goods for Sale or Lease | Inventory intended for sale |

| Goods for Processing or Repair | Items to be modified or repaired |

| Consumable Goods | Food, plants, items that may be used up or disposed of |

Issuance, Validity, and Responsibility

- ATA Carnets are not issued by CBSA

- Carnets are issued by recognized issuing organizations

- In Canada, carnets are guaranteed by the Canadian Chamber of Commerce and obtained through approved carnet service providers

| Topic | Details |

|---|---|

| Validity | Up to 1 year from date of issue |

| Authorized Stay | May be shorter if CBSA sets an earlier re-export date |

| Responsibility | Carnet holder is responsible for compliance and re-export |

If goods are not re-exported within the authorized time limits (including expiry of the carnet), duties and taxes may become payable.

The carnet holder should obtain the carnet, and the driver/carrier must have the carnet available for presentation at the border.

Declaring an ATA Carnet Shipment in ACI eManifest

ATA Carnet shipments transported by highway into Canada must still be reported to CBSA under ACI/eManifest using a Highway Cargo Document.

ACI requirements apply even though the goods are temporarily imported.

Steps to Report an ATA Carnet in ACI

To report an ATA Carnet shipment electronically:

- Create an ACI Shipment designated as non-CSA

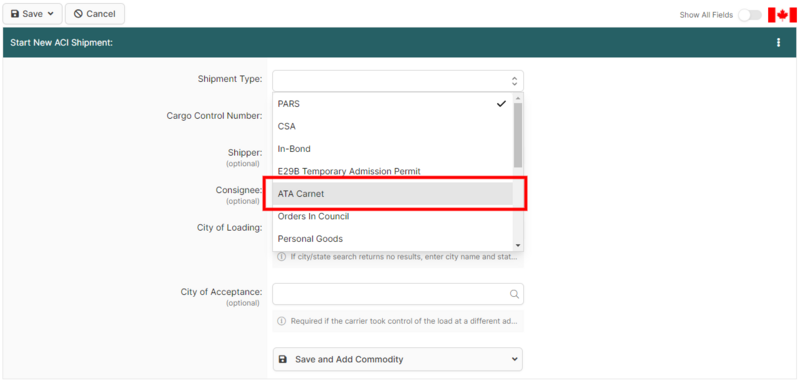

- Select ATA Carnet as the shipment type (if using BorderConnect)

- Transmit the shipment as part of the ACI eManifest within required timelines

Required ACI Shipment Information

Although an ATA Carnet shipment is different from a PARS shipment, all standard ACI cargo data elements are still required.

| Required Element | Description |

|---|---|

| Cargo Control Number (CCN) | Unique CCN with bar code |

| Shipper | Name and address |

| Consignee | Carnet holder or designated party |

| Commodity Description | Description matching carnet goods list |

ATA Carnet Processing at the Border

At the First Port of Arrival (FPOA), the driver must present the ATA Carnet document to CBSA for processing and validation as directed by the officer.

- CBSA will validate the importation counterfoil

- CBSA may set a specific re-exportation date

- The carnet must accompany the goods

|

💡 A paper A8A is not a standard requirement for ATA Carnet processing. A8A documents are associated with in-bond movements only. |

If carnet goods are moving in-bond (for example, unaccompanied goods moving to an office of destination), the movement must comply with CBSA carnet and in-bond procedures.

|

⚠️ ACI/eManifest highway cargo and conveyance data must generally be received and validated by CBSA at least one (1) hour prior to arrival at the First Port of Arrival (FPOA). |

ATA Carnet and the United States

U.S. Customs and Border Protection (CBP) recognizes ATA Carnets as a mechanism for the temporary importation of eligible goods into the United States.

CBP guidance explains carnet processing at entry and re-export and how carnets simplify CBP formalities.

CBP regulations (19 CFR Part 114) define the categories of goods that may be covered by an ATA Carnet.

| Category | Covered Goods |

|---|---|

| Commercial Samples | Demonstration and sales samples |

| Professional Equipment | Tools and equipment for professional use |

| Exhibitions/Fairs | Trade show and exhibition materials |

ATA Carnet and ACE Truck eManifest (Highway Mode)

In the highway environment, ATA Carnet processing in the United States often involves:

- Presenting the carnet paperwork at the port

- Following port-specific CBP instructions

- Filing an empty ACE Manifest when only carnet goods are present (unless additional shipments are also on the conveyance)

Specific filing practices may vary by port and service provider.

Summary: ATA Carnet at a Glance

| Topic | Key Point |

|---|---|

| Purpose | Temporary import/export of eligible goods |

| Canadian Alternative | E29B Temporary Admission Permit |

| ACI Required | Yes (highway mode) |

| Paper Carnet Required | Yes (presented at border) |

| Validity | Up to 1 year (authorized stay may be shorter) |

References

- ↑ 1.0 1.1 1.2 1.3 CBSA Memorandum D8-1-7 — Use of A.T.A. Carnets and Canada/Chinese Taipei Carnets for the Temporary Admission of Goods https://www.cbsa-asfc.gc.ca/publications/dm-md/d8/d8-1-7-eng.html

- ↑ CBSA — ACI/eManifest Highway Electronic Commerce Client Requirements https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html

- ↑ CBP — ATA Carnet Frequently Asked Questions (FAQ's) https://www.cbp.gov/trade/programs-administration/entry-summary/ata-carnet-faqs

- ↑ 19 CFR § 114.22 — Coverage of carnets https://www.law.cornell.edu/cfr/text/19/114.22