ATA Carnet (CBP CBSA)

| This article is part of the Shipment Release Types Guide |

An ATA Carnet is an international customs document used to simplify temporary admission (temporary import/export) of eligible goods. In Canada, carnets are an alternative to documenting temporary importations on form E29B (Temporary Admission Permit), and they act as a guarantee for duties/taxes if the goods are not re-exported within the authorized time limits.[1]

Carnets are typically used for commercial samples, professional equipment, and goods for exhibitions/fairs. Carnets generally cannot be used for goods intended for sale, lease, processing, repair, or for consumable goods (e.g., food/plants) that may be used up or disposed of.[1]

Carnets are issued by recognized issuing organizations (not by CBSA). In Canada, carnets are guaranteed by the Canadian Chamber of Commerce and are obtained through carnet service providers/issuing offices.[1]

Validity / time limits: Carnets are valid for one year from the date of issue, but the authorized period of stay in Canada can be shorter if CBSA sets an earlier re-exportation date on the importation counterfoil. Duties and taxes may apply if goods are not re-exported within the authorized time limits (including if the carnet expires).[1]

The carnet should be obtained by the party temporarily importing the goods (the carnet holder). The carrier/driver must have the carnet available to present to border officials when reporting the goods.[1]

Declaring an ATA Carnet in ACI eManifest

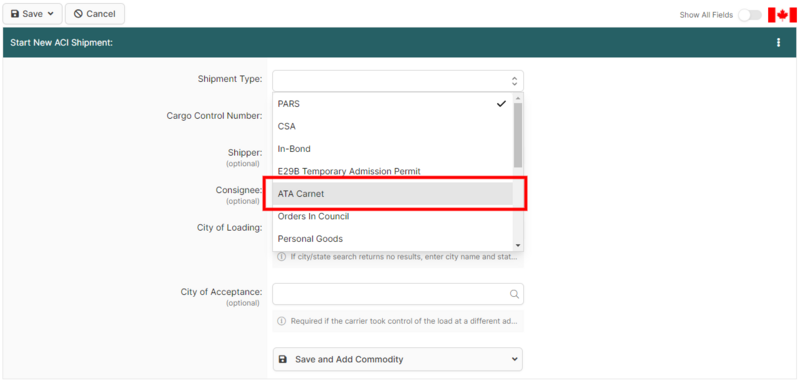

Carnet shipments transported by highway into Canada must still be reported to CBSA under ACI/eManifest using a Highway Cargo Document (cargo control document) within the required timelines (generally validated at least one hour prior to arrival at the first port of arrival).[2] To report an ATA Carnet the carrier will need to create an ACI Shipment designated as non-CSA (or "ATA Carnet" if using BorderConnect's ACI eManifest software), and ensure that the shipment is transmitted as part of their ACI eManifest.

Although an ATA Carnet Shipment is different from a PARS shipment, the carrier will still need to provide a unique Cargo Control Number, as well as all other information normally required for an ACI Shipment including Shipper, Consignee and Commodity information.

At the border, the driver must present the ATA Carnet document to CBSA for processing/validation as directed by the officer. A paper A8A is not a standard requirement for carnet processing; A8A (in-bond cargo control document) is associated with in-bond movements. If the goods are moving in-bond (for example, unaccompanied carnet goods moving in bond to an office of destination), the movement must be handled according to CBSA’s carnet and in-bond procedures.[1]

| ACI/eManifest highway cargo and conveyance data must generally be received and validated by CBSA at least one (1) hour prior to arrival at the first port of arrival (FPOA). |

ATA Carnet and the United States

CBP recognizes ATA carnets as a mechanism to temporarily import eligible goods into the United States under carnet procedures. CBP’s official ATA Carnet FAQ describes the carnet as simplifying CBP formalities for temporary importation and explains general carnet use/processing expectations at entry and re-exportation.[3]

CBP’s carnet regulations (19 CFR Part 114) specify the categories of goods that may be covered by an ATA carnet, including commercial samples, professional equipment, and exhibitions/fairs under the applicable international conventions.[4]

ATA Carnet and ACE truck eManifest (highway mode)

In the highway environment, carnet processing frequently involves presenting the carnet paperwork at the port for CBP validation and following the instructions of the port and the filer’s service provider. Some ACE highway filing guidance from service providers states that carnet cargo may be handled by transmitting the trip/conveyance portion and omitting standard electronic cargo/shipment details for carnet moves; carriers should follow current CBP guidance and their provider’s documented process for highway mode carnet movements.[3][5]

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 CBSA Memorandum D8-1-7 — Use of A.T.A. Carnets and Canada/Chinese Taipei Carnets for the Temporary Admission of Goods https://www.cbsa-asfc.gc.ca/publications/dm-md/d8/d8-1-7-eng.html

- ↑ CBSA — ACI/eManifest Highway Electronic Commerce Client Requirements https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html

- ↑ 3.0 3.1 CBP — ATA Carnet Frequently Asked Questions (FAQ's) https://www.cbp.gov/trade/programs-administration/entry-summary/ata-carnet-faqs

- ↑ 19 CFR § 114.22 — Coverage of carnets (Cornell LII) https://www.law.cornell.edu/cfr/text/19/114.22

- ↑ CrimsonLogic North America — ACE Highway 18 – How do I file an ATA Carnet? https://crimsonlogic-northamerica.com/docs/ace-highway-18-how-do-i-file-an-ata-carnet/