US In Bond Manager Guide (CBP)

|

🔖 This article is part of the BorderConnect U.S. In-Bond Manager Guide |

The BorderConnect U.S. In-Bond Manager is an add-on module that allows users to electronically file, update, and monitor U.S. in-bond shipments directly with U.S. Customs and Border Protection (CBP). The module supports required electronic reporting of in-bond arrivals, exports, diversions, and related updates through ACE, while also providing visibility into in-bond status through integrated In-Bond Status Queries.

This guide explains the regulatory background, compliance requirements, and how to use BorderConnect’s In-Bond Manager to meet CBP’s electronic in-bond obligations.

Introduction

CBP published a final rule in 2017 that modernized the U.S. in-bond process and expanded mandatory electronic reporting through ACE (Automated Commercial Environment).[1]

CBP later announced enforcement requiring that all covered in-bond arrivals, exports, and diversions be reported electronically through ACE effective July 29, 2019. As of that date, CBP no longer accepts paper CBP Form 7512 to perform arrival or export reporting for covered shipments (with limited exemptions, such as air mode).[2]

While paper documentation may still be used for local port operations or as supporting paperwork, electronic reporting is the compliance requirement. Paper documents do not replace required ACE updates.[2]

Key In-Bond Compliance Requirements

| Requirement | CBP Rule / Guidance |

|---|---|

| Electronic reporting | Required for arrivals, exports, and diversions |

| Arrival reporting deadline | Within 2 business days of arrival |

| Export reporting deadline | Generally within 2 business days of export |

| FIRMS code | Mandatory for arrival reporting (all modes except air) |

| Diversions | Must be requested electronically and approved by CBP |

| Maximum transit time | 30 days (with limited regulatory exceptions) |

Notable regulatory changes

- Electronic filing is mandatory. All covered in-bond updates must be transmitted through a CBP-approved electronic interface (ACE/ABI/EDI).[3]

- Arrival reporting within 2 business days. Arrival notifications must include the FIRMS code identifying the physical location of the goods at the port.[4]

- Electronic export reporting required. Export updates must be transmitted electronically for covered shipments.[5]

- Electronic diversion requests required. Diversions require CBP authorization via a CBP-approved EDI interface.[3]

- FIRMS code enforcement. As of August 10, 2024, ACE rejects in-bond arrival transactions submitted without a FIRMS code (all modes except air).[6]

- 30-day transit limit. Most in-bond movements are subject to a 30-day maximum transit time.[1]

Registering and Getting Started

Step 1: BorderConnect account

If your company does not already have a BorderConnect account, visit www.borderconnect.com and complete the registration process.

Step 2: Filer code setup

- If you do not have a filer code

-

- Contact BorderConnect support for assistance submitting a Letter of Intent.

- CBP will issue a filer code (processing times vary).

- A BorderConnect representative will configure your filer code for in-bond-only filing.

- If you already have a filer code

- BorderConnect will configure your existing filer code for use with the U.S. In-Bond Manager.

Once configured, your account will be enabled to transmit electronic in-bond messages through ACE.

In-Bond Dashboard Overview

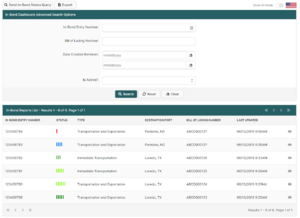

The In-Bond Dashboard is the central workspace for managing U.S. in-bond shipments. From this page, users can:

- Search and filter in-bond shipments

- View in-bond status at a glance

- Confirm whether arrivals, exports, or diversions were successfully reported

- Access related status queries and notices

- Drill into shipment-level details

Reporting In-Bond Arrivals and Exports

Reporting In-Bond Arrivals and Exports

BorderConnect allows users to electronically report in-bond arrivals and exports with minimal data entry.

- Arrivals must generally be reported within 2 business days of arrival at the destination or export port.[4]

- Arrival transactions must include the correct FIRMS code for the facility where the freight is physically located.

- As of August 10, 2024, ACE rejects arrival updates submitted without a FIRMS code (all modes except air).[6]

QP In-Bond Filing

Creating and Submitting a QP In-Bond

Use BorderConnect’s U.S. In-Bond Manager to electronically file QP (Quick Processing) in-bond entries directly with CBP, including associated bills of lading and commodities.

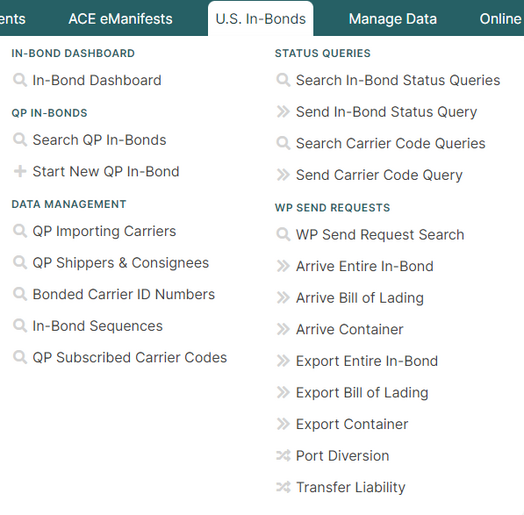

U.S. In-Bond Manager Menu Overview

In-Bond Dashboard

Displays all in-bond shipments with summary information such as in-bond type, status, and ports.

In-Bond Status Queries

- Search In-Bond Status Queries – View historical queries and CBP responses

- Send In-Bond Status Query – Request current status from CBP for a specific in-bond

WP Send Requests

WP messages are used to electronically report in-bond updates to CBP.

- Arrive Entire In-Bond – Report arrival of the full in-bond

- Arrive Bill of Lading – Report arrival of a single bill

- Arrive Container – Report arrival of a container

- Export Entire In-Bond – Report export of the in-bond

- Export Bill of Lading – Report export of a bill

- Export Container – Report export of a container

- Port Diversion – Request a change to the destination or export port

- Transfer Liability – Transfer in-bond liability to another party (use with caution)

Electronic reporting of these updates is required for covered shipments.[2]

Frequently Asked Questions

Do I still need paper CBP Form 7512? CBP no longer accepts paper Form 7512 to perform arrival or export reporting for covered shipments. Some ports may still request paper copies for operational purposes, but electronic reporting remains mandatory.[2]

Does electronic reporting eliminate all port stops? Not always. Electronic reporting may remove stops made solely for arrival/export posting, but inspections, holds, or local port procedures may still require presentation.

Who is responsible for compliance? The bond-obligated party remains responsible, even when filing is delegated to an authorized agent.[1]

References

- ↑ 1.0 1.1 1.2 https://public-inspection.federalregister.gov/2017-20495.pdf

- ↑ 2.0 2.1 2.2 2.3 https://content.govdelivery.com/accounts/USDHSCBP/bulletins/24effce

- ↑ 3.0 3.1 https://www.govinfo.gov/content/pkg/CFR-2024-title19-vol1/pdf/CFR-2024-title19-vol1-part18.pdf

- ↑ 4.0 4.1 https://www.law.cornell.edu/cfr/text/19/18.1

- ↑ https://www.law.cornell.edu/cfr/text/19/18.7

- ↑ 6.0 6.1 https://content.govdelivery.com/accounts/USDHSCBP/bulletins/3b37839