Personal Goods (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

| This article is about the Canadian Shipment Type. For the U.S. Shipment Type, see Personal Shipment (CBP Shipment Type) |

Personal Goods—also referred to as casual (non-commercial) goods—are goods imported into Canada other than commercial goods. These are items imported for personal use and not for sale or for any commercial, industrial, occupational, or institutional purpose.

In the context of highway carriers using ACI/eManifest, Personal Goods shipments are reported as a non-CSA highway cargo document and must be transmitted to CBSA within the required advance reporting timeframes.

What Qualifies as Personal Goods

To qualify as Personal (Casual) Goods, the shipment must meet all of the following:

| Requirement | Description |

|---|---|

| Purpose | Imported for personal use only |

| Commercial Use | Not for sale, resale, or business use |

| Importer | Typically an individual traveller |

| Revenue | No income-generating or occupational activity |

|

💡 If goods are imported for business or revenue-generating purposes, they do not qualify as Personal Goods and must be reported as a commercial shipment. |

Declaring a Personal Goods Shipment in ACI eManifest

Personal Goods transported by a highway carrier must be reported on an ACI eManifest.

To report a Personal Goods shipment:

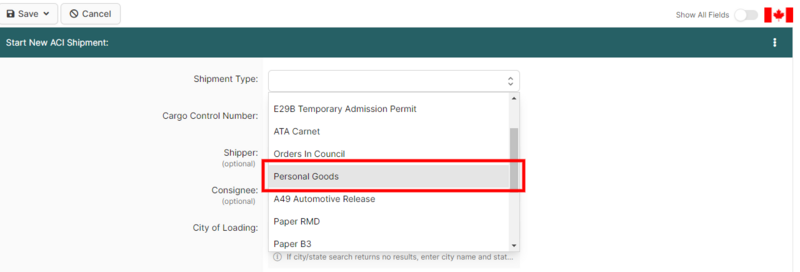

- Create an ACI Shipment

- Select Personal Goods as the shipment type (when using BorderConnect ACI eManifest software)

- Transmit the shipment as part of the ACI eManifest

Required ACI Shipment Information

Although Personal Goods shipments are different from PARS shipments, standard ACI cargo data is still required.

| Required Element | Notes |

|---|---|

| Cargo Control Number (CCN) | Unique CCN must be provided |

| Shipper | Individual or party shipping the goods |

| Consignee | Individual importing the goods |

| Description of Goods | Clear description of personal items |

Accounting and Documentation at the Border

At the First Port of Arrival (FPOA), the driver must present the applicable release and accounting documentation for the shipment, based on the importer’s situation.

Casual (Non-Commercial) Importations

When accounting is required for casual goods, CBSA uses:

- Form BSF715 / BSF715-1 (formerly B15 / B15-1)

Settlers’ Effects / Personal Effects

For settlers’ effects (including “goods to follow”), CBSA uses:

- Form BSF186 — Personal Effects Accounting Document

- Form BSF186A — Continuation Sheet

Cargo Control Documentation

Where a paper cargo control document is required, CBSA guidance references:

- Form A8A(B) — Cargo Control Document (for recording the CCN)

Summary: Personal Goods at a Glance

| Topic | Key Point |

|---|---|

| Goods Type | Personal / casual (non-commercial) |

| ACI Required | Yes |

| Broker Involved | No |

| Common Forms | BSF715, BSF186 / BSF186A |

| CCN Required | Yes |

|

⚠️ To comply with ACI eManifest requirements, highway carriers must ensure that electronic cargo and conveyance data is transmitted and accepted by CBSA at least one (1) hour prior to arrival at the border. For mixed loads, any PARS shipments must also meet standard ACI timing requirements. |

References

- ↑ CBSA Memorandum D6-2-6 — Refund of Duties and Taxes on Non-commercial Importations (definition of “Casual Goods”) https://www.cbsa-asfc.gc.ca/publications/dm-md/d6/d6-2-6-eng.pdf

- ↑ 2.0 2.1 2.2 CBSA — ACI/eManifest Highway Electronic Commerce Client Requirements (ECCRD) https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html

- ↑ 3.0 3.1 CBSA Memorandum D17-1-3 — Casual Importations https://www.cbsa-asfc.gc.ca/publications/dm-md/d17/d17-1-3-eng.html

- ↑ CBSA Memorandum D17-1-3 (PDF) https://www.cbsa-asfc.gc.ca/publications/dm-md/d17/d17-1-3-eng.pdf

- ↑ CBSA Memorandum D2-2-1 — Settlers’ Effects – Tariff Item No. 9807.00.00 https://www.cbsa-asfc.gc.ca/publications/dm-md/d2/d2-2-1-eng.html

- ↑ CBSA — Cargo control and bar-coded labels https://www.cbsa-asfc.gc.ca/services/carrier-transporteur/codes-labels-etiquette-eng.html