Personal Shipment (CBP Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

| This article is about the U.S. Shipment Type. For the Canadian Shipment Type, see Personal Goods (CBSA Shipment Type) |

A Personal Shipment, also commonly referred to as Household Goods or Unaccompanied Articles, is a U.S. Shipment Type used in the ACE truck manifest workflow when a highway carrier is transporting an individual’s non-commercial personal/household effects (i.e., effects not imported for sale and not imported as commercial merchandise).[1]

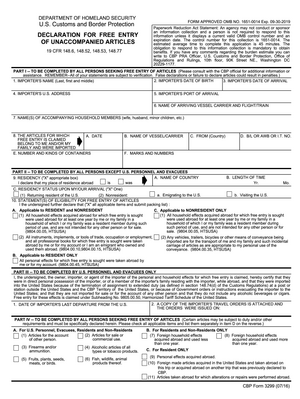

In practice, Personal Shipment moves commonly rely on CBP Form 3299 (Declaration for Free Entry of Unaccompanied Articles) to support claims for duty-free entry of qualifying personal/household effects when those effects do not accompany the importer at arrival.[2][3]

A common scenario is when an individual moving from Canada to the United States hires a carrier to transport their used household goods/personal effects. Some items may still be dutiable depending on eligibility and the facts of the shipment, even when transported as household/personal effects (for example, certain newly-acquired foreign articles).[4]

Declaring a Personal Shipment in ACE eManifest

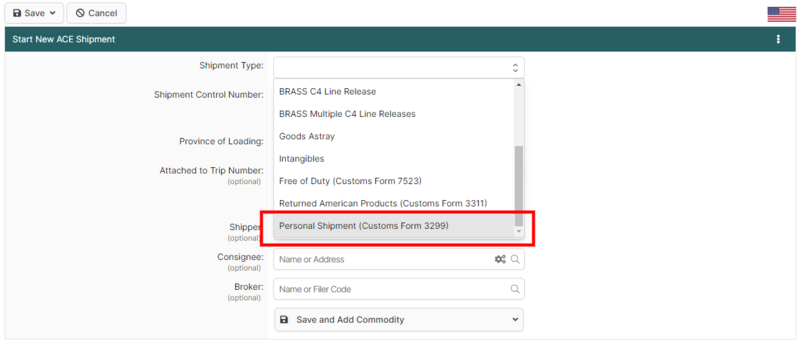

Personal Shipments being transported by a highway carrier are required to be reported on an ACE eManifest. Automated Commercial Environment Review of Shipment Release Types: Trucks To report a Personal Shipment the carrier will need to create an ACE Shipment with the Shipment Type "Personal Shipment" (may also be called "Household Goods" or "Unaccompanied Articles" depending on software being used), and ensure that the shipment is transmitted on their ACE eManifest. The example below shows how to report Personal Shipments using BorderConnect ACE Manifest Software.

Although a Personal Shipment is different from a PAPS shipment, the carrier will still need to provide a unique Shipment Control Number, as well as all other information normally required for an ACE Shipment including Shipper, Consignee and Commodity information.

As with all Informal Entries, no Customs Broker should be involved and the carrier will not receive an Entry Number for the shipment. At the border, the driver must present a completed Customs Form 3299 to the officer.

When completing the Customs Form 3299, the statement that the goods are "household effects" is not enough information. The complete inventory of imported goods will be treated as the packing list and must be provided to the officer upon request.

References

- ↑ 19 CFR § 143.21(e) (Informal entry eligibility includes “household effects used abroad and personal effects…not intended for sale”) https://www.ecfr.gov/current/title-19/chapter-I/part-143/subpart-C/section-143.21

- ↑ CBP Form 3299 (Declaration of Free Entry of Unaccompanied Articles) — official CBP forms page https://www.cbp.gov/document/forms/form-3299-declaration-free-entry-unaccompanied-articles

- ↑ Federal Register — “Declaration for Free Entry of Unaccompanied Articles (CBP Form 3299)” (notes the form is provided for by 19 CFR 148.6 and supports duty-free claims) https://www.federalregister.gov/documents/2022/10/27/2022-23406/declaration-for-free-entry-of-unaccompanied-articles-cbp-form-3299

- ↑ CBP Form 3299 (PDF, current version) https://www.cbp.gov/sites/default/files/2024-05/cbp_form_3299_0.pdf