Personal Shipment (CBP Shipment Type)

| This article is part of the Shipment Release Types Guide |

| This article is about the U.S. Shipment Type. For the Canadian Shipment Type, see Personal Goods (CBSA Shipment Type) |

A Personal Shipment, aka Household Goods or Unaccompanied Articles, is a U.S. Shipment Type for goods to clear through US Customs and Border Protection and an ACE Manifest. It is a type of Informal Entry that allows for the release at the border of shipments consisting of non-commercial, personal, used goods being transported by a highway carrier.

To qualify as a Personal Shipment the goods must not be for sale, must not be the property of a business, and must not be brand new, unused goods. The most common scenario in which a highway carrier would use this shipment type would occur when an individual moving from Canada to the United States engages the carrier to transport their personal belongings.

Declaring a Personal Shipment in ACE eManifest

Personal Shipments being transported by a highway carrier are required to be reported on an ACE eManifest. Automated Commercial Environment Review of Shipment Release Types: Trucks To report a Personal Shipment the carrier will need to create an ACE Shipment with the Shipment Type "Personal Shipment" (may also be called "Household Goods" or "Unaccompanied Articles" depending on software being used), and ensure that the shipment is transmitted on their ACE eManifest. The example below shows how to report Personal Shipments using BorderConnect ACE Manifest Software.

Although a Personal Shipment is different from a PAPS shipment, the carrier will still need to provide a unique Shipment Control Number, as well as all other information normally required for an ACE Shipment including Shipper, Consignee and Commodity information.

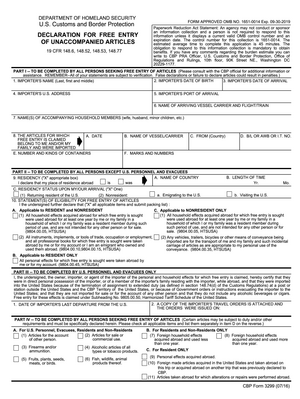

As with all Informal Entries, no Customs Broker should be involved and the carrier will not receive an Entry Number for the shipment. At the border, the driver must present a completed Customs Form 3299 to the officer.

When completing the Customs Form 3299, the statement that the goods are "household effects" is not enough information. The complete inventory of imported goods will be treated as the packing list and must be provided to the officer upon request.