Temporary Admission Permit (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

Temporary Admission Permit (TAP)

A guide to reporting temporary imports (BSF865 and E29B) in ACI eManifest.

Overview

A Temporary Admission Permit (TAP) is a release option used to import goods into Canada temporarily without paying full duties and taxes, provided they are re-exported within a specific timeframe.

This is commonly used for trade show displays, professional equipment, or tools entering Canada for a specific job.

Important Update (CARM): As of October 2024, CBSA has split the documentation for temporary imports based on whether they are Commercial or Non-Commercial.[1]

🆕 The New Standard: BSF865 vs. E29B

While carriers often call all temporary imports "E29Bs," the actual document the driver carries now depends on the purpose of the goods. As part of CARM Release 3, CBSA implemented the BSF865 for commercial temporary importations under Tariff Item No. 9993.00.00.[2]

| Import Type | Form Used | How It Works |

|---|---|---|

| Commercial | BSF865 | Used for business purposes. Created and managed via the CARM Client Portal.[3] |

| Non-Commercial | E29B | Used for personal effects or individual travelers. Still issued as a Paper Permit.[1] |

Determining the Type

Commercial (BSF865)

Use this if the importer is a business or the goods are for a business purpose.

- Trade Shows: Booths, displays, demos.

- Tools of Trade: Professional equipment to perform a service.

- Testing: Equipment imported for evaluation.

- Samples: Commercial samples (not sold).

Non-Commercial (E29B)

Use this if the importer is an individual.

- Travelers: High-value personal items.

- Personal Gear: Musical instruments, cameras, or sports equipment for personal use.

Reporting in ACI eManifest

Regardless of whether the goods use a BSF865 or an E29B form, the ACI reporting process is the same.

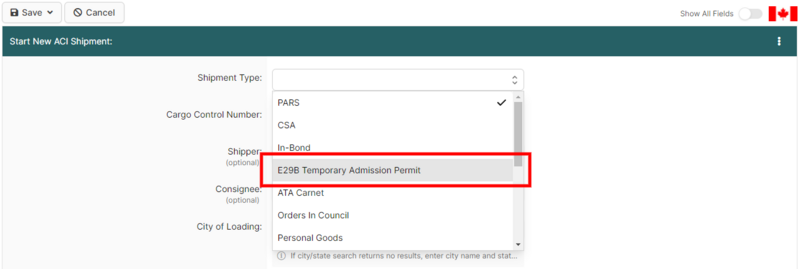

1 Start New Shipment

Inside your ACI eManifest, click Create New Shipment.

- Shipment Type: Select Temporary Admission Permit.

- Cargo Control Number: Assign a unique CCN (Carrier Code + Number).

2 Complete Details

- Shipper/Consignee: Enter the full address details.

- Commodity: Clear description (e.g., "Trade Show Display Booth").

- Transmit: Save and click Sync with CBSA.

Note: Even though the software menu may say "E29B", you select this shipment type for BSF865 shipments as well.

At the Border

What the Driver Needs

- The Permit: The completed BSF865 (printed from CARM) or the E29B form.

- Supporting Docs: An invoice or item list describing the goods.

- Security: Proof of security deposit (if required by the specific permit).

- Lead Sheet: The ACI eManifest Lead Sheet with the barcode.

1-Hour Rule: As with all commercial shipments, the ACI eManifest must be on file for at least 1 hour prior to arrival.[4]