Canada Customs Invoice (Customs Glossary)

| This article is part of the Customs Glossary Guide |

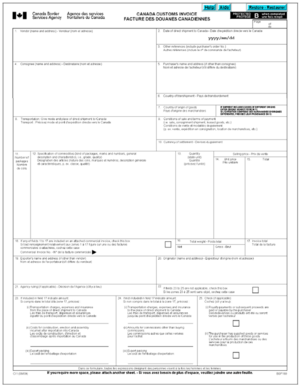

A Canada Customs Invoice (CCI) is a critical document used in international trade involving the importation of goods into Canada. Issued by the exporter, the Canada Customs Invoice serves as a comprehensive declaration of the goods being shipped and is essential for customs clearance at the Canadian border. This article defines what a Canada Customs Invoice is in North American trade and explores the scenarios in which this document is utilized.

What is a Canada Customs Invoice (CCI)?

The Canada Customs Invoice is a specific customs declaration document used for goods imported into Canada. It is a legal requirement for importers and exporters to accurately complete the CCI for all commercial shipments entering Canada. The CCI contains detailed information about the goods, their value, country of origin, and other pertinent data necessary for customs authorities to assess import duties, taxes, and eligibility for preferential trade agreements.

Scenarios in Which a Canada Customs Invoice is Used:

Cross-Border Importation:

Scenario: A company in the United States wants to export products to a customer in Canada. Usage of Canada Customs Invoice: The exporting company prepares a Canada Customs Invoice, which includes a detailed description of the goods, their value, and the terms of sale. The invoice accompanies the shipment, providing customs authorities with all the necessary information for proper assessment of import duties and taxes at the Canadian border.

Commercial Shipments:

Scenario: A Canadian retailer imports electronic devices from a supplier in China for domestic distribution. Usage of Canada Customs Invoice: The supplier in China prepares a Canada Customs Invoice that contains the product details, quantity, unit price, and shipment information. This document is critical for customs clearance in Canada, ensuring compliance with import regulations and accurate assessment of duties and taxes.

Preferential Tariff Treatment:

Scenario: A company in Mexico exports textiles to Canada, eligible for preferential trade benefits under the North American Free Trade Agreement (NAFTA) or the Canada-United States-Mexico Agreement (CUSMA). Usage of Canada Customs Invoice: To claim preferential tariff treatment, the exporter in Mexico prepares a Canada Customs Invoice that includes a statement of origin, certifying that the goods meet the origin criteria outlined in the trade agreement. This document allows the importer in Canada to benefit from reduced or duty-free tariffs.

Temporary Imports:

Scenario: A company in Europe sends equipment to a Canadian subsidiary for temporary use in a research project. Usage of Canada Customs Invoice: The European company prepares a Canada Customs Invoice indicating that the equipment is a temporary import and providing details about its intended use and expected re-exportation date. This ensures that customs authorities understand the temporary nature of the shipment and that appropriate customs procedures are followed.

Samples and Promotional Materials:

Scenario: A Canadian company sends product samples to potential customers in the United States for evaluation. Usage of Canada Customs Invoice: The Canadian company prepares a Canada Customs Invoice with a detailed description of the samples, indicating their non-commercial nature and zero value. This document facilitates the movement of samples across the border without incurring import duties or taxes.

Conclusion:

The Canada Customs Invoice plays a fundamental role in North American trade, providing customs authorities with essential information for the proper assessment of import duties, taxes, and trade preferences. By accurately completing and providing this document, businesses ensure compliance with Canadian import regulations and facilitate the seamless movement of goods across the border, enhancing efficiency and promoting smooth international trade within the region.