Canada Customs Invoice (Customs Glossary)

|

🔖 This article is part of the Customs Glossary Guide |

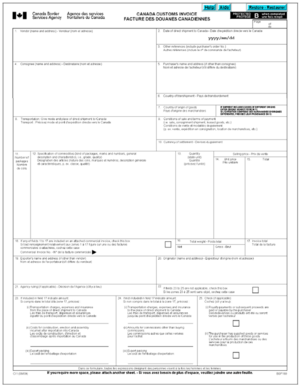

Canada Customs Invoice (CCI)

A comprehensive declaration document required for customs clearance of goods imported into Canada.

Overview

A Canada Customs Invoice (CCI) is a critical document used in international trade involving the importation of goods into Canada. Issued by the exporter, the Canada Customs Invoice serves as a comprehensive declaration of the goods being shipped and is essential for customs clearance at the Canadian border.

It acts as the primary source of information for the Canada Border Services Agency (CBSA) to assess duties, taxes, and admissibility.

Legal Requirement: It is a legal requirement for importers and exporters to accurately complete the CCI for commercial shipments entering Canada valued at over $2,500 CAD, or when the commercial invoice lacks necessary data.

What is a Canada Customs Invoice?

The Canada Customs Invoice is a specific customs declaration document used for goods imported into Canada. The CCI contains detailed information about the goods, their value, country of origin, and other pertinent data necessary for customs authorities to assess import duties, taxes, and eligibility for preferential trade agreements.

Key Data Elements Include:

- Vendor and Consignee names and addresses.

- Detailed description of goods.

- Unit price and total value.

- Country of Origin.

- Currency of settlement.

- Terms of sale (Incoterms).

Common Usage Scenarios

[Image of container ship]

The following scenarios illustrate when and how the Canada Customs Invoice is utilized in North American trade:

| Scenario Type | Description & Usage |

|---|---|

| Cross-Border Importation (USA to Canada) |

Scenario: A company in the United States wants to export products to a customer in Canada. |

| Commercial Shipments (International) |

Scenario: A Canadian retailer imports electronic devices from a supplier in China for domestic distribution. |

| Preferential Tariff Treatment (CUSMA/USMCA) |

Scenario: A company in Mexico exports textiles to Canada, eligible for benefits under CUSMA (formerly NAFTA). |

| Temporary Imports |

Scenario: A company in Europe sends equipment to a Canadian subsidiary for temporary use in a research project. |

| Samples & Promotional Materials |

Scenario: A Canadian company sends product samples to potential customers in the United States (or vice versa). |

Conclusion

The Canada Customs Invoice plays a fundamental role in North American trade, providing customs authorities with essential information for the proper assessment of import duties, taxes, and trade preferences. By accurately completing and providing this document, businesses ensure compliance with Canadian import regulations and facilitate the seamless movement of goods across the border, enhancing efficiency and promoting smooth international trade within the region.