How Do I Become A Bonded U.S. Highway Carrier (DIY Customs Consulting)

|

🔖 This article is part of the Customs Compliance Guide |

Bonded Highway Carrier (US)

A status allowing carriers to transport freight through the U.S. without paying duties at the first port of entry.

Overview

A Bonded Carrier is a transportation provider licensed to move freight through or across U.S. points of entry (ports, border crossings) without having to pay duties, taxes, and/or fees on those goods during that specific portion of their transportation.

By posting security with U.S. Customs and Border Protection (CBP), a bonded carrier allows an importer to defer customs clearance until the cargo reaches a specific inland destination or is exported to a foreign country.

Key Benefit: Utilizing a bonded carrier allows cargo to move "In-Bond," meaning it can travel to an inland bonded warehouse or move in-transit through the U.S. (e.g., Canada to Mexico) without paying U.S. consumption duties.

Why Become a Bonded Carrier?

Carriers obtain a Customs Bond to unlock specific operational capabilities and eligibility for trusted trader programs.

| Capability | Description |

|---|---|

| In-Bond Movements | Move commercial goods from the border to an inland destination (e.g., airport, rail yard, seaport, or bonded warehouse) for clearance closer to the final destination. |

| In-Transit Moves | Transport goods through a U.S. corridor (e.g., Ontario to Michigan to New York to Quebec) without formally entering the goods into the commerce of the United States. |

| Trusted Trader Eligibility | A bond is a prerequisite for applying to the FAST Program (Free and Secure Trade) and C-TPAT (Customs Trade Partnership Against Terrorism). |

How to Become a Bonded Carrier

To apply, a carrier must post financial security through an approved surety company and submit specific documentation to CBP.

Step 1: Financial Security

Highway carriers typically post a bond amount ranging from $5,000 to $25,000 depending on the volume and type of activity. This is done through an approved Surety Company.

Step 2: Required Documentation

The application package generally includes the original filled-out copies of the following forms:

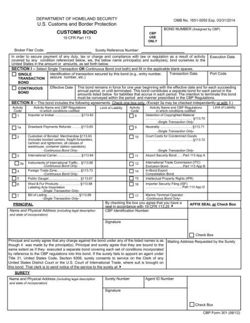

- CBP Form 301: The Customs Bond application itself.

- CBP Form 301A: The Addendum to the bond application (if applicable).

- CBP Form 5106: Importer Identity Form (used to create the carrier's record in CBP systems).

Step 3: Critical Data Elements

The Customs Bond Form 301 must include supporting details to be accepted:

- Proof of Ownership: Documents verifying the company owner and legal structure.

- Business Number: Assigned by the IRS (foreign companies may leave this blank or use a CBP-assigned number).

- Signatures & Seals: Signature of the Owner/CEO, witness signatures, and the embossed seal of the Surety Company.

- Power of Attorney: Authorization for the surety to act on the carrier's behalf.

Official Resources & Forms

Refer to these official CBP documents and pages for the most current regulatory requirements.

- CBP Bond Centralization: Program Overview

- Official Surety List: Surety Company Names and Codes List (CBP)

- FAQ: In-Bond Regulatory Changes FAQ

- Guide: General Guidelines for Completing CBP Form 301

- Contact: CBP Bond Team Email Address:

cbp.bondquestions@dhs.gov