Master Provisional (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

Master Provisional Shipment (Canada/CBSA)

A guide to the Master Provisional Entry (MPE), a release option for goods where the final value for duty cannot be determined at the time of import.

Overview

A Master Provisional Entry (MPE) is a specialized Shipment Type used when eligible goods need to be released before the final accounting is complete, specifically because the final value for duty is unknown at the time of importation.

Authorized under Section 32(2) of the Customs Act, this allows importers to bring in goods now and pay the final duties later once the costs are finalized.[1]

Not a General Release: You cannot use this just because you don't have an invoice yet. It is restricted to specific large-scale projects and military goods where valuation is genuinely impossible until installation or completion.

✅ Eligibility Criteria

CBSA Memorandum D17-1-13 restricts this shipment type to specific categories. Authorization is required before the goods move.

| Category | Description |

|---|---|

| Construction Plans | Blueprints, drawings, or plans for facility installations or construction projects in Canada. |

| Large Installations | Complex machinery, systems, and equipment imported as part of a major installation where final costs fluctuate. |

| Military Equipment | Equipment imported by the Department of National Defence (DND). |

| DND Components | Parts and materials for repair, maintenance, modification, or testing of military equipment.[2] |

🔐 Advance Authorization (CARM)

A carrier cannot simply decide to use Master Provisional. The Importer must do the legwork first.

- The Request: The Importer or Broker submits a "Master Provisional Authorization" request via the CARM Client Portal.

- The Approval: CBSA Trade Operations reviews the request.

- The Letter: If approved, CBSA issues a Letter of Authorization. The carrier should ensure this letter exists before moving the load.

Reporting in ACI eManifest

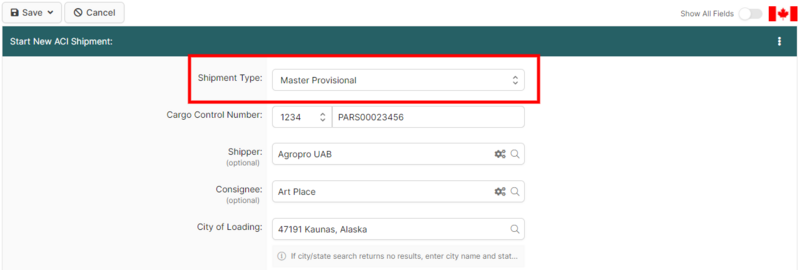

1 Start New Shipment

Inside your ACI eManifest, click Create New Shipment.

- Shipment Type: Select Master Provisional.

- Cargo Control Number: Assign a unique CCN (Carrier Code + Number).

2 Enter Details

Complete the shipment details as normal.

- Shipper/Consignee: Standard address details.

- Commodity: Description must match the authorized goods (e.g., "Construction Plans" or "DND Equipment").

- Transmit: Save and click Sync with CBSA.

At the Border

What the Driver Needs

- ACI Lead Sheet: The driver presents the lead sheet with the barcoded CCN (or CRN).

- Authorization Reference: While the driver doesn't always need the full letter, the Importer/Broker must be able to provide the CBSA Authorization Reference if the officer requests it.[2]

1-Hour Rule: The ACI eManifest must be on file and accepted for at least 1 hour prior to arrival.[3]

References

- ↑ Customs Act, s.32 — Interim accounting / release prior to accounting. https://laws-lois.justice.gc.ca/eng/acts/C-52.6/section-32.html

- ↑ 2.0 2.1 CBSA Memorandum D17-1-13 — Interim Accounting (Master Provisional Entry). https://www.cbsa-asfc.gc.ca/publications/dm-md/pdf/d17-1-13-eng.pdf

- ↑ CBSA — ACI/eManifest Highway Electronic Commerce Client Requirements. https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html