Orders In Council (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

Orders in Council Shipment (Canada/CBSA)

A guide to reporting goods that qualify for special duty/tax remission (e.g., Remission Orders) in ACI eManifest.

Overview

An Orders in Council (OIC) shipment allows goods to enter Canada under special legal authority that provides relief (remission) from duties or taxes.

An "Order in Council" is a legal instrument issued by the Governor General on the advice of the Cabinet. In the import world, these are often Remission Orders—specific rules that say, "If you import X goods under Y conditions, you don't have to pay duty."[1]

It's Not a "Free Pass": An OIC does not exempt you from reporting. You must still file an ACI eManifest, but the accounting (duty payment) changes based on the OIC number you declare.

📜 Common Examples

The most frequent use of this shipment type is for specific government relief programs.

| Order Type | Description |

|---|---|

| Courier Imports Remission Order (CIRO) | Exempts duties/taxes on low-value courier shipments (typically under $20 CAD). Excludes alcohol, tobacco, and cannabis.[2] |

| Steel Surtax Remission | Provides relief from surtaxes on specific steel products, often requiring a specific OIC code on the accounting declaration.[3] |

| Emergency Remission | Temporary relief for goods imported during emergencies (e.g., medical supplies during a pandemic). |

🔄 The CARM Context

With the implementation of CARM, how you "claim" an Order in Council has shifted slightly for the importer/broker.

- The Carrier: Continues to report the shipment type as "Orders in Council" in ACI eManifest.

- The Importer/Broker: Must enter the specific OIC Number in the Special Authority OIC field on the Commercial Accounting Declaration (CAD).[3]

Reporting in ACI eManifest

Even though the goods may be duty-free, they are not exempt from ACI eManifest rules.

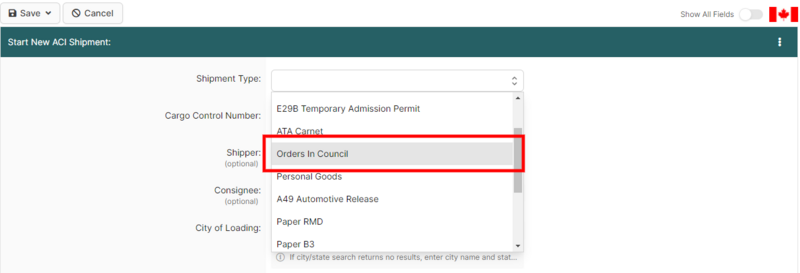

1 Start New Shipment

Inside your ACI eManifest, click Create New Shipment.

- Shipment Type: Select Orders in Council.

- Cargo Control Number: Assign a unique CCN (Carrier Code + Number).

2 Complete Details

- Shipper/Consignee: Standard address details required.

- Commodity: Clear description of the goods.

- Transmit: Save and click Sync with CBSA.

Documentation at the Border

Paper Requirements (When Applicable)

While ACI is electronic, some OIC shipments (depending on the port and specific order) may still require a paper trail.

- ACI Lead Sheet: Always present the lead sheet with the CCN barcode.

- Paper A8A (If Requested): If the port requires a paper package (e.g., for complex remissions), use Form A8A.

- Acquittal Field: On the paper A8A, write the OIC Number in the "Acquittal No." field so the officer knows which legal authority you are claiming.[4]

1-Hour Rule: The ACI eManifest must be on file and accepted for at least 1 hour prior to arrival.[5]

References

- ↑ Privy Council Office – Orders in Council. https://www.canada.ca/en/privy-council/services/orders-in-council.html

- ↑ CBSA Memorandum D8-2-16 — Courier Imports Remission. https://www.cbsa-asfc.gc.ca/publications/dm-md/d8/d8-2-16-eng.html

- ↑ 3.0 3.1 Customs Notice 25-19: United States Surtax Remission Order (2025). https://www.cbsa-asfc.gc.ca/publications/cn-ad/cn25-19-eng.html

- ↑ CBSA Form A8A(B) — In Bond – Cargo Control Document. https://www.cbsa-asfc.gc.ca/publications/forms-formulaires/a8a-b-eng.html

- ↑ CBSA ACI/eManifest Highway Electronic Commerce Client Requirements. https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html