Paper B3 (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

Paper B3 Shipment (Canada/CBSA)

A guide to handling paper accounting packages for commercial goods (Legacy B3 / CAD) in ACI eManifest.

Overview

A Paper B3 (historically the "Canada Customs Coding Form") refers to a shipment where the importer or broker accounts for duties and taxes using a physical paper package presented at the border, rather than electronic EDI clearance (PARS).

In the context of ACI eManifest, selecting "Paper B3" as a shipment type informs CBSA that there will be no electronic link (PARS) associated with the Cargo Control Number, and that the driver will present full accounting paperwork.

CARM Update: Under the CBSA Assessment and Revenue Management (CARM) initiative, the B3 form has been officially replaced by the Commercial Accounting Declaration (CAD). However, the term "Paper B3" persists in many software systems to denote a physical paper release.[1]

📄 When is Paper Accounting Used?

With mandatory eManifest and IID/PARS, paper releases are now exceptions. They typically occur when:

| Scenario | Description |

|---|---|

| System Outages | When electronic release systems (Cadence/EDI) are down. |

| Non-EDI Importers | Small importers or one-time importers who do not have a broker or EDI setup. |

| Regulated Goods | Certain goods requiring paper permits that cannot be transmitted digitally. |

Carrier Responsibilities

Even though the release is paper, the manifest must be electronic.

Reporting in ACI eManifest

Paper B3 shipments must be reported on your ACI eManifest.[2]

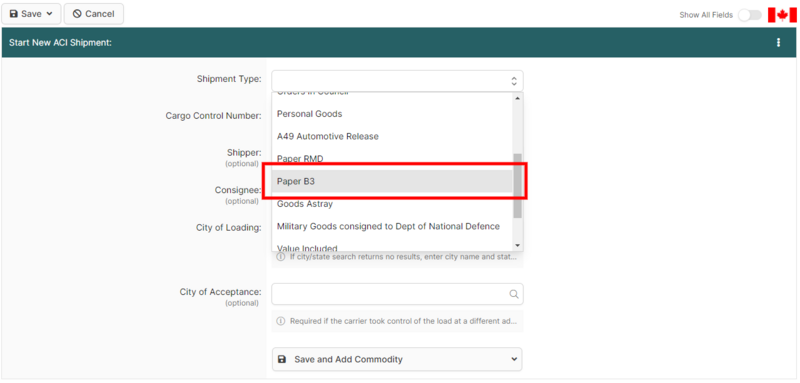

1. Create Shipment: Start a new ACI Shipment in BorderConnect. 2. Shipment Type: Select Paper B3. 3. Cargo Control Number: Assign a unique CCN (Carrier Code + Number). 4. Transmit: Sync with CBSA at least 1 hour prior to arrival.

At the Border

The driver must have the full package in hand. Unlike PARS, a lead sheet alone is not enough.

- ACI Lead Sheet: The carrier's proof of transmission with the barcode.

- The Paper Package: The completed Commercial Accounting Declaration (CAD) or legacy B3 form prepared by the broker/importer.

- Supporting Docs: Invoices, permits, or certificates required for release.[3]

🔄 CARM Terminology

| Legacy Term | New Term (CARM) | Impact on Driver |

|---|---|---|

| Form B3-3 | Commercial Accounting Declaration (CAD) | The form looks different, but the process (handing paper to the officer) is the same. |

| Paper B3 (Software) | Paper Release | Select "Paper B3" in BorderConnect to indicate a paper release package. |

References

- ↑ CBSA Memorandum D17-1-10 — Coding of Customs Accounting Documents. https://www.cbsa-asfc.gc.ca/publications/dm-md/d17/d17-1-10-eng.html

- ↑ CBSA — Commercial reporting requirements (ACI/eManifest) https://www.cbsa-asfc.gc.ca/prog/aci-manif-ipec/req-exig-eng.html

- ↑ Accounting for Imported Goods and Payment of Duties Regulations (SOR/86-1062)