Personal Shipment (CBP Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

|

🔖 This article is about the U.S. Shipment Type. For the Canadian Shipment Type, see Personal Goods (CBSA Shipment Type) |

Personal Shipment (ACE Shipment Type)

A guide to transporting unaccompanied household goods and personal effects into the United States.

Overview

A Personal Shipment (also known as Household Goods or Unaccompanied Articles) is a U.S. shipment type used when a highway carrier transports an individual's non-commercial personal or household effects. These are items not imported for sale and not intended as commercial merchandise.

This shipment type is most commonly used when an individual moves from Canada to the United States and hires a carrier to transport their used belongings. While many items are duty-free, some—such as newly acquired foreign articles—may still be dutiable depending on eligibility.

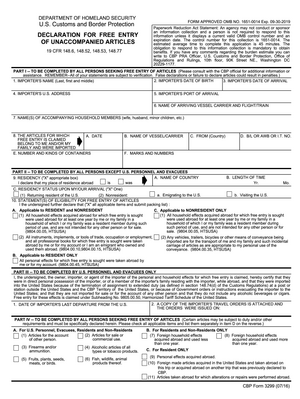

CBP Form 3299: These movements rely on the Declaration for Free Entry of Unaccompanied Articles to support claims for duty-free entry when the effects do not accompany the importer at the time of arrival.

Documentation and Eligibility

The Role of CBP Form 3299

Qualifying for duty-free entry requires specific documentation under 19 CFR 148.6.

- The Form: The driver must present a completed CBP Form 3299 to the officer at the border.

- The Inventory: Simply stating "household effects" is insufficient; a complete inventory of all imported goods acts as the packing list and must be provided upon request.

- No Broker Required: As an informal entry, a customs broker is not involved, and the carrier will not receive a formal entry number.

Reporting in ACE eManifest

Personal Shipments transported by a highway carrier must be reported on an ACE eManifest.

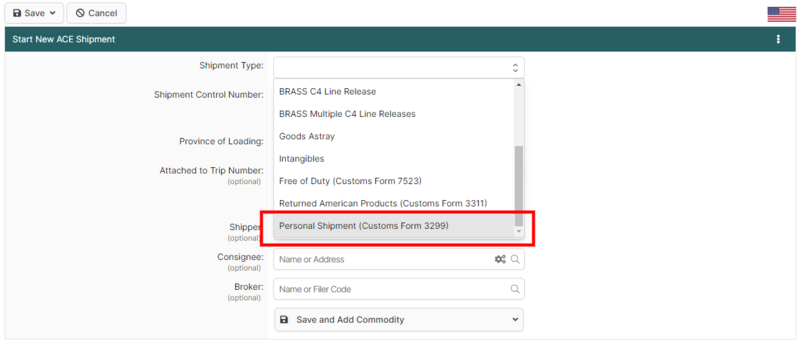

1 Create the ACE Shipment

In BorderConnect, start a new ACE Shipment and select Personal Shipment (or "Household Goods" depending on your configuration) as the Shipment Type.

- Shipment Control Number (SCN): Even though it is a personal move, you must assign a unique SCN to the shipment.

- Data Requirements: You must still provide all standard information, including Shipper, Consignee, and Commodity information.

2 Transmit and Arrive

- Transmission: Transmit the manifest to CBP and ensure it is in "On File" status.

- At the Booth: The driver presents the ACI lead sheet and the physical CBP Form 3299 to the officer.

- Inspection: Be prepared for the officer to verify the physical inventory against the provided packing list.

References