Section 321 (CBP Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

|

⚠️ CBP has suspended duty-free de minimis treatment under Section 321 for commercial low-value shipments (effective August 29, 2025). As a result, shipments generally cannot be released duty-free under Section 321, and Type 86 processing is no longer available for these shipments. Commercial goods now require formal or informal entries that allow for duty and fee collection. |

Section 321 (CBP Shipment Type)

A guide to the U.S. de minimis administrative exemption and the 2025 suspension of duty-free treatment.

Overview

A Section 321 shipment refers to the U.S. de minimis administrative exemption under 19 U.S.C. § 1321(a)(2)(C). Historically, this allowed low-value commercial shipments to be admitted without formal entry requirements or duty payments.

In 2016, the threshold was increased from $200 to $800 by the Trade Facilitation and Trade Enforcement Act (TFTEA). However, as of late 2025, the landscape for these shipments has changed significantly due to executive and legislative action.

The Aggregation Rule: To qualify, a person must not have imported more than $800 in total de minimis value on a single day. CBP enforces this to prevent "splitting" shipments to avoid duties.

2025 Suspension of Duty-Free Treatment

On July 30, 2025, the White House issued an Executive Order "Suspending Duty-Free De Minimis Treatment for All Countries," effective August 29, 2025.

- Duty Collection: Shipments under $800 are no longer automatically duty-free.

- Entry Type 86: CBP has suspended the use of Entry Type 86 for duty-free processing of these loads.

- Revenue Assessment: Goods must now be processed under entries that allow for the collection of duties and fees (e.g., Type 01 or Type 11).

- Postal Transition: International postal networks moved to a value-based duty assessment model by late February 2026.

Reporting a Section 321 in ACE Manifest

Despite the suspension of duty-free status, the electronic manifest requirement remains for commercial shipments. Carriers must still report these loads to avoid penalties ranging from $5,000 to $10,000.

Required Data Elements

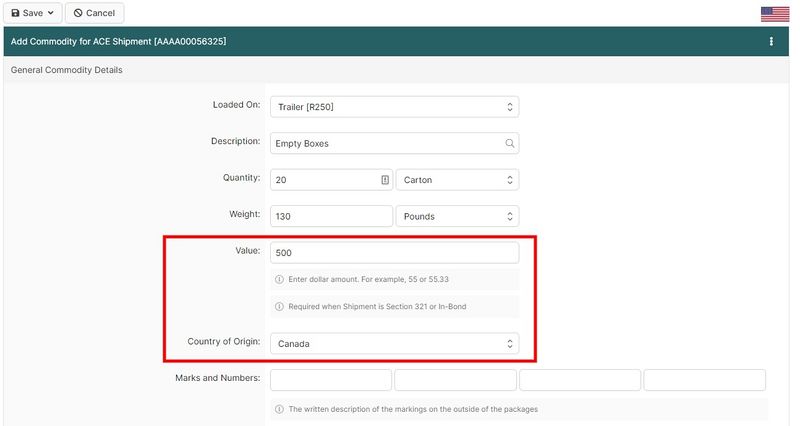

To report a Section 321 shipment in BorderConnect:

- Shipment Control Number (SCN): A unique number for the shipment.

- Shipper & Consignee: Full name and address for both parties.

- Commodity Details: Accurate description and piece count.

- Value & Origin: The declared value (USD) and Country of Origin.

Using the CSV Shipment Upload Feature

For high-volume e-commerce carriers, manually entering hundreds of shipments is inefficient. BorderConnect offers a CSV Upload Feature to handle bulk shipments.

- Efficiency: Import thousands of shipments in seconds.

- Validation: The system checks for errors before transmission.

- Guide: See the CSV Upload Guide for templates and instructions.

References