Returned American Products (CBP Shipment Type)

| This article is part of the Shipment Release Types Guide |

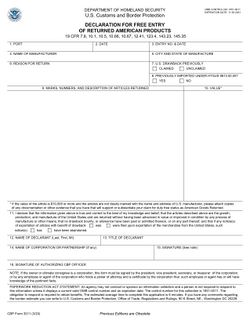

A Returned American Products Shipment, known for its corresponding form, CBP Form 3311, is a U.S. Shipment Type for goods to clear through US Customs and Border Protection and on an ACE Manifest. It is a type of Informal Entry that allows for the release at the border of shipments consisting of products of the United States being returned.

To qualify as a Returned American Products Shipment, the goods must have either been rejected or returned by the foreign purchaser to the United States for credit, and must not have been allowed Customs drawback or exemption from internal revenue tax when they were exported, or be otherwise subject to duty. Because the carrier would not normally be in a position to make these determinations it is important that the carrier rely on the importer or their customs broker to advise if Returned American Products should be the shipment type.[1][2]

Declaring a Returned American Products Shipment in ACE Manifest

Returned American Products Shipments are currently exempt from ACE Manifest filing requirements,[1] but carriers may elect to submit ACE information for them for the benefit of their records and for faster border processing times. To report a Returned American Products Shipment the carrier will need to create an ACE Shipment with the Shipment Type "Returned American Products" (may also be called "CBP Form 3311" depending on software being used), and ensure that the shipment is transmitted on their ACE Manifest. The example below shows how to report Returned American Products shipments using BorderConnect's ACE Manifest software.

Although a Returned American Products Shipment is different from a PAPS shipment, the carrier will still need to provide a unique Shipment Control Number, as well as all other information normally required for an ACE Shipment including Shipper, Consignee and Commodity information.

As with all Informal Entries, no Customs Broker should be involved and the carrier will not receive an Entry Number for the shipment. At the border, the driver must present a completed Customs Form 3311 in duplicate to the officer.

References

- ↑ 1.0 1.1 Automated Commercial Environment Review of Shipment Release Types: Trucks https://www.cbp.gov/sites/default/files/documents/shipment_types_3.pdf

- ↑ 19 CFR 10.1 https://www.law.cornell.edu/cfr/text/19/10.1