CSA (CBSA Shipment Type)

|

🔖 This article is part of the Shipment Release Types Guide |

|

🔖 This article is about the CSA Shipment Type. For general program info, visit CSA Program Information |

CSA Shipment (Canada/CBSA)

A guide to the Customs Self-Assessment (CSA) program, a "Trusted Trader" option for streamlined border clearance.

Overview

CSA (Customs Self Assessment) is a clearance option designed for low-risk, pre-approved companies. It allows goods to enter Canada without standard border release processing (like PARS).

Instead of the broker clearing the goods at the border, the Importer self-assesses duties and taxes later. This means the driver can often pass through the booth simply by verifying their identity.

The "Triangle" Rule: CSA can only be used if all three parties are authorized: 1. The Importer (must be CSA approved). 2. The Carrier (must be CSA approved). 3. The Driver (must have a FAST or CDRP card).

✅ Eligibility & Restrictions

Not all goods qualify for CSA, even if the importer is approved.

| Requirement | Detail |

|---|---|

| Origin | Goods must be shipped directly from the United States or Mexico. |

| No OGDs | Goods cannot require permits, licenses, or certificates from other government departments (e.g., CFIA, NRC).[1] |

| Responsibility | The Importer is responsible for telling the carrier if a load is eligible for CSA. |

Two Ways to Report CSA

Carriers have two options for handling CSA shipments. Most use Option 1 (Exempt).

Option 1: Traditional (Exempt)

Most Common. CSA shipments are exempt from ACI eManifest data requirements.

- Manifest: You do not need to create an electronic manifest for these goods.

- Mixed Loads: If you have PARS and CSA on the same truck, you only manifest the PARS. The CSA goods remain "off the books" electronically.

- Border: The driver relies entirely on the 3 Barcodes (see below).

Option 2: Electronic (ACI)

Voluntary. Some carriers choose to transmit CSA data electronically for tracking visibility.

- Manifest: You create a manifest and add the shipment as type CSA.

- Setup: You must notify CBSA's Technical Support Unit before starting this.[2]

- Border: The driver presents the ACI Lead Sheet plus their FAST card.

At the Border (The 3 Barcodes)

The Paper Process

If using Option 1 (Traditional), the driver does not present a manifest lead sheet. Instead, they present three specific items to the officer:

1. The Driver's Card: A valid FAST or CDRP card (scanned first). 2. The Carrier Code: A barcode of the carrier's code. 3. The Importer's Business Number: A barcode of the Importer's CSA Business Number (BN).

Note: If any one of these three items is missing or invalid, the driver will be refused CSA clearance and must clear via the regular commercial lane (PARS).

Creating a CSA Shipment (Option 2)

If you choose to file electronically, follow these steps in BorderConnect.

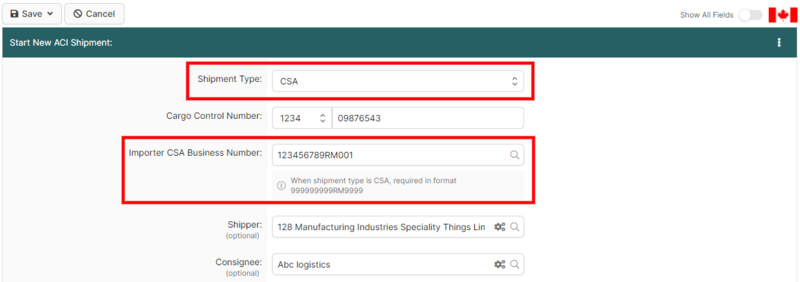

1 Start New Shipment

Inside your ACI eManifest, click Create New Shipment.

- Shipment Type: Select CSA.

- Cargo Control Number: Enter a unique CCN (Carrier Code + Number).

2 Complete & Transmit

- Enter the Shipper, Consignee, and Commodity details.

- Click Save.

- Click Sync with CBSA on the manifest page.