Instruments of International Trade (CBSA Cargo Exemption)

|

🔖 This article is part of the Shipment Release Types Guide |

|

🔖 This article is about the Canadian Shipment Type. For the U.S. Shipment Type, see Instruments of International Traffic |

Instruments of International Trade (IIT)

A guide to reporting empty racks, totes, bins, and pallets entering Canada (CBSA) as a Cargo Exception.

Overview

Instruments of International Trade (IIT) is a CBSA Cargo Exception used for reusable transport articles that enter Canada temporarily to transport commercial goods.

Because these items (empty racks, bins, totes) are considered equipment rather than "goods" being imported, they are exempt from full cargo data requirements. Instead of creating a full shipment, you simply flag the conveyance as carrying IITs.[1]

The Difference: Unlike a commercial shipment (PARS), you do not create a cargo shipment for IITs. You report them using an Exception Code on the truck or trailer profile.

✅ What Qualifies as IIT?

To qualify, the items must be reusable transport articles not intended for sale.[2]

| Eligible Items | Examples |

|---|---|

| Reusable Containers | Shipping tanks, baskets, bins, boxes, crates. |

| Transport Equipment | Pallets, racks, skids, totes. |

| Registration | Items often have container bank numbers or Ottawa file numbers (though not strictly required for the exception code itself, having proof of ownership/contract is recommended).[3] |

Reporting in ACI eManifest

Because IITs are a "Cargo Exception," the reporting process in BorderConnect is different from a standard shipment.

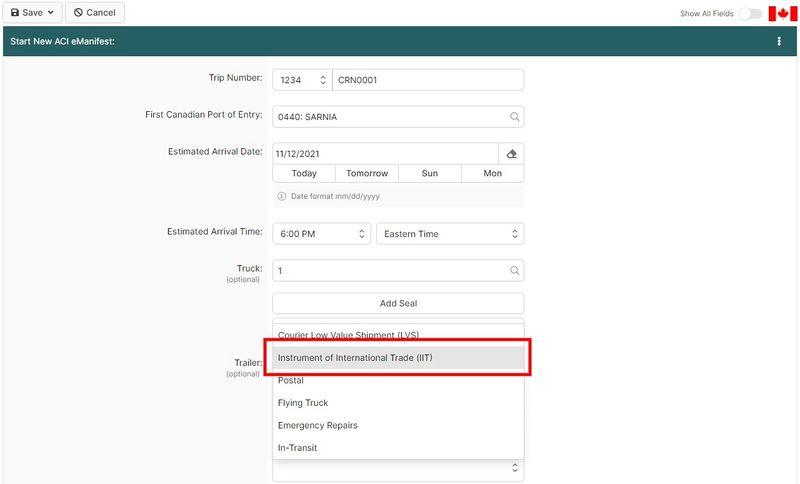

How to Set the Exception Code

1. Start New Manifest: Create your Trip (Conveyance) as usual. 2. Do Not Create a Shipment: Skip the "Create New Shipment" button if IITs are the only thing you are hauling. 3. Edit Trailer/Truck: Open the Trailer (or Truck) section of the manifest. 4. Set Exception: In the Loaded Status or Exception field, select Instruments of International Trade (IIT). 5. Save: This puts the "IIT" flag on the manifest transmission.

🚚 Common Scenarios

Scenario A: IIT Only

You are hauling empty racks back to Canada.

- Manifest: Trip Only (No Shipments).

- Flag: Trailer set to "IIT".

- Result: Manifest transmits with 0 Shipments, but the IIT flag tells CBSA why the trailer isn't "Empty".[4]

Scenario B: Mixed Load

You are hauling racks (IIT) AND auto parts (PARS).

- Manifest: Create Trip + Create PARS Shipment.

- Flag: Trailer set to "IIT" (or mixed).

- Result: The PARS covers the goods; the IIT flag covers the racks.

At the Border

What the Driver Needs

References

- ↑ 1.0 1.1 CBSA Electronic Commerce Client Requirements Document (ECCRD) – Advance Commercial Information (ACI)/eManifest Highway (section 3.6.2). https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html

- ↑ CBSA Memorandum D3-4-2 – Definition of Instruments of International Trade (IIT). https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-4-2-eng.pdf

- ↑ CBSA Memorandum D3-1-1 – Policy respecting the importation and transportation of goods. https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-1-eng.html

- ↑ CBSA eManifest Portal User Guide. https://www.cbsa-asfc.gc.ca/prog/manif/portal-portail/guide-eng.html

- ↑ CBSA Memorandum D3-1-5 – International commercial transportation. https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-5-eng.html