Instruments of International Trade (CBSA Cargo Exemption): Difference between revisions

No edit summary |

No edit summary |

||

| (3 intermediate revisions by the same user not shown) | |||

| Line 1: | Line 1: | ||

{{note|This article is part of the [[Shipment_Types_For_ACE_and_ACI_eManifest|Shipment Release Types Guide]]|info}} | {{note|This article is part of the [[Shipment_Types_For_ACE_and_ACI_eManifest|Shipment Release Types Guide]]|info}} | ||

{{disambig|This article is about the Canadian Shipment Type. For the U.S. Shipment Type, see [[Instruments_of_International_Traffic_(CBP_Shipment_Type)|Instruments of International Traffic]]|info}} | |||

{{#ev:youtube| | {{#ev:youtube|qMJrqWo0yaA|960|center|How to create a IIT shipment in ACI using BorderConnect.}} | ||

[[Image:Returnable_Bin.jpg|250px|right|thumb|Empty bins which can qualify as '''Instruments of International Trade''']] | |||

'''Instruments of International Trade''', aka IIT, is a Canadian [[Shipment_Types_For_ACE_and_ACI_eManifest|Cargo Exception]] (an exception to full cargo data requirements) under CBSA ACI/eManifest highway rules. It is used for certain '''empty containers and similar transport articles''' (for example, shipper/importer-owned empty containers registered under Ottawa file or with container bank numbers) that are used to transport commercial goods to and from Canada (e.g., shipping tanks, pallets, baskets, bins, boxes, crates, racks, totes, etc.).<ref name="eccrd-hiway">CBSA Electronic Commerce Client Requirements Document (ECCRD) – Advance Commercial Information (ACI)/eManifest Highway (see section 3.6.2 Instruments of International Trade (IIT)): https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html</ref><ref name="d3-4-2">CBSA Memorandum D3-4-2 (Highway pre-arrival and reporting requirements) – Definition of Instruments of International Trade (IIT): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-4-2-eng.pdf</ref><ref name="portal-exceptions">CBSA eManifest Portal Help – Cargo Exception(s): https://www.cbsa-asfc.gc.ca/prog/manif/portal-portail/help-aide/ce-ef-eng.html</ref> | |||

IITs are intended for '''international transportation use''' and are not entering Canada for sale. Applicable time limits for temporary admission vary by the type of conveyance/container (for example, CBSA notes 30-day export limits for certain conveyances/trailers and 365 days for containers under tariff item 9801).<ref name="d3-1-5">CBSA Memorandum D3-1-5 – International commercial transportation (Time limits, para. 28-29): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-5-eng.html</ref> | |||

Although carriers may be familiar with IIT handling, the determination of whether goods qualify should be made by the party responsible for the goods and supported by source documentation available upon request by CBSA (e.g., contract of carriage, invoices, etc.).<ref name="policy-d3-1-1">CBSA Memorandum D3-1-1 – Policy respecting the importation and transportation of goods (carrier obligations / source documentation): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-1-eng.html</ref> | |||

== Declaring IITs in ACI eManifest == | == Declaring IITs in ACI eManifest == | ||

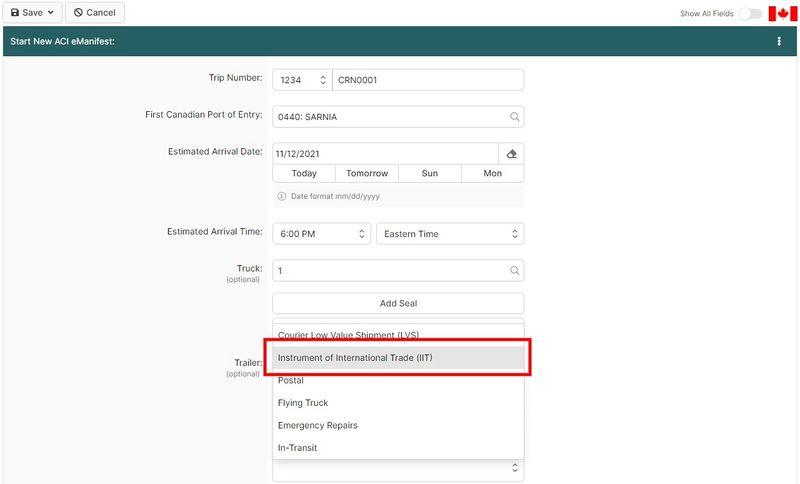

Instruments of International Trade are required to be reported on an [[ | Instruments of International Trade are required to be reported on an [[ACI_eManifest_Software_User_Guide_(CBSA)|ACI eManifest]]. To report an IIT shipment the carrier will need to set the IIT exception code on either the truck, trailer or container, depending on where the IITs are loaded. This tells Customs that there are IITs aboard. The carrier will not create an ACI Shipment to report the IITs, they must be reported using the exception code only.<ref name="eccrd-hiway" /><ref name="portal-guide">CBSA eManifest Portal User Guide (exceptions and “only carrying goods qualifying as an exception”): https://www.cbsa-asfc.gc.ca/prog/manif/portal-portail/guide-eng.html</ref> The example below shows how to report Instruments of International Trade using [https://borderconnect.com BorderConnect's] [[ACI eManifest Software User Guide (CBSA)|ACI eManifest software]]. | ||

[[Image:Iitaci1.jpg|800px]] | [[Image:Iitaci1.jpg|800px]] | ||

If Instruments of International Trade are the only thing being transported, the carrier can transmit the ACI eManifest with only the trip (conveyance) portion, and no ACI Shipments attached. Otherwise, the other shipments can be added and the manifest can be transmitted normally.</ | If Instruments of International Trade are the only thing being transported, the carrier can transmit the ACI eManifest with only the trip (conveyance) portion, and no ACI Shipments attached. Otherwise, the other shipments can be added and the manifest can be transmitted normally.<ref name="eccrd-hiway" /><ref name="portal-guide" /> | ||

Even when exempt from full ACI/eManifest cargo data, the conveyance/goods must still be reported to CBSA at the first port of arrival (FPOA) in the prescribed manner (electronic/oral/written depending on the scenario).<ref name="policy-d3-1-1" /> | |||

{{reminder|In order to comply with ACI eManifest requirements you are required to ensure that both your manifest and the broker clearance on any PARS shipments are on file with CBSA for at least one hour before the driver arrives at the border.}} | {{reminder|In order to comply with ACI eManifest requirements you are required to ensure that both your manifest and the broker clearance on any PARS shipments are on file with CBSA for at least one hour before the driver arrives at the border.}}<ref name="eccrd-hiway" /> | ||

== References == | == References == | ||

Latest revision as of 15:11, 16 January 2026

| This article is part of the Shipment Release Types Guide |

| This article is about the Canadian Shipment Type. For the U.S. Shipment Type, see Instruments of International Traffic |

Instruments of International Trade, aka IIT, is a Canadian Cargo Exception (an exception to full cargo data requirements) under CBSA ACI/eManifest highway rules. It is used for certain empty containers and similar transport articles (for example, shipper/importer-owned empty containers registered under Ottawa file or with container bank numbers) that are used to transport commercial goods to and from Canada (e.g., shipping tanks, pallets, baskets, bins, boxes, crates, racks, totes, etc.).[1][2][3]

IITs are intended for international transportation use and are not entering Canada for sale. Applicable time limits for temporary admission vary by the type of conveyance/container (for example, CBSA notes 30-day export limits for certain conveyances/trailers and 365 days for containers under tariff item 9801).[4]

Although carriers may be familiar with IIT handling, the determination of whether goods qualify should be made by the party responsible for the goods and supported by source documentation available upon request by CBSA (e.g., contract of carriage, invoices, etc.).[5]

Declaring IITs in ACI eManifest

Instruments of International Trade are required to be reported on an ACI eManifest. To report an IIT shipment the carrier will need to set the IIT exception code on either the truck, trailer or container, depending on where the IITs are loaded. This tells Customs that there are IITs aboard. The carrier will not create an ACI Shipment to report the IITs, they must be reported using the exception code only.[1][6] The example below shows how to report Instruments of International Trade using BorderConnect's ACI eManifest software.

If Instruments of International Trade are the only thing being transported, the carrier can transmit the ACI eManifest with only the trip (conveyance) portion, and no ACI Shipments attached. Otherwise, the other shipments can be added and the manifest can be transmitted normally.[1][6]

Even when exempt from full ACI/eManifest cargo data, the conveyance/goods must still be reported to CBSA at the first port of arrival (FPOA) in the prescribed manner (electronic/oral/written depending on the scenario).[5]

| In order to comply with ACI eManifest requirements you are required to ensure that both your manifest and the broker clearance on any PARS shipments are on file with CBSA for at least one hour before the driver arrives at the border. |

References

- ↑ 1.0 1.1 1.2 1.3 CBSA Electronic Commerce Client Requirements Document (ECCRD) – Advance Commercial Information (ACI)/eManifest Highway (see section 3.6.2 Instruments of International Trade (IIT)): https://www.cbsa-asfc.gc.ca/prog/manif/eccrdhi-deccerout-eng.html

- ↑ CBSA Memorandum D3-4-2 (Highway pre-arrival and reporting requirements) – Definition of Instruments of International Trade (IIT): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-4-2-eng.pdf

- ↑ CBSA eManifest Portal Help – Cargo Exception(s): https://www.cbsa-asfc.gc.ca/prog/manif/portal-portail/help-aide/ce-ef-eng.html

- ↑ CBSA Memorandum D3-1-5 – International commercial transportation (Time limits, para. 28-29): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-5-eng.html

- ↑ 5.0 5.1 CBSA Memorandum D3-1-1 – Policy respecting the importation and transportation of goods (carrier obligations / source documentation): https://www.cbsa-asfc.gc.ca/publications/dm-md/d3/d3-1-1-eng.html

- ↑ 6.0 6.1 CBSA eManifest Portal User Guide (exceptions and “only carrying goods qualifying as an exception”): https://www.cbsa-asfc.gc.ca/prog/manif/portal-portail/guide-eng.html