Main Page: Difference between revisions

No edit summary |

No edit summary |

||

| Line 19: | Line 19: | ||

<h2 id="mp-tfa-h2" class="mp-h2">Featured Article</h2> | <h2 id="mp-tfa-h2" class="mp-h2">Featured Article</h2> | ||

<div id="mp-tfa" class="mp-contains-float"> | <div id="mp-tfa" class="mp-contains-float"> | ||

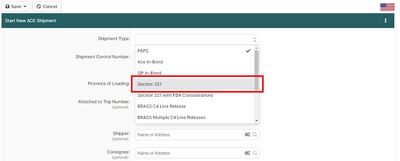

[[Image:Section321-1.jpg|400px|thumb|right|Selecting '''Section 321''' shipment type from the Start New ACE Shipment page]]A '''Section 321''' is a U.S. [[Shipment_Types_For_ACE_and_ACI_eManifest|Shipment Type]] for goods to clear through U.S. Customs and Border Protection on an [https://www.borderconnect.com/ace-e-manifest/index.htm ACE Manifest]. It is a type of entry that allows for the release at the border of shipments valued at 800 U.S. dollars or less. | |||

To qualify for Section 321 release a shipment must not exceed 800 U.S. dollars in value and must not be one of several lots covered by a single order or contract, the value of which would exceed $800. CBP may also refuse to release a shipment as Section 321 when taking into account risk considerations that may vary for different classes or kinds of merchandise. | |||

As of March 7, 2016 Section 321 informal entry limits increased from $200.00 USD to $800.00 USD. | |||

On November 26, 2018 U.S. Customs and Border Protection began a phased approach for Section 321 non-compliance on ACE Manifests. Starting January 1, 2019 CBP will require an ACE Manifest for all Section 321 shipments. Failure to include Section 321 shipments on ACE Manifests may result in a monetary penalty starting at $5000 USD (for the first offence).<ref name="requirements">CSMS 18-000731 https://csms.cbp.gov/viewmssg.asp?Recid=23943&page=&srch_argv=18-000731&srchtype=all&btype=&sortby=&sby=</ref> | |||

Shipments released as Section 321 are free of duty and tax. | |||

</div> | |||

</div> | </div> | ||

Revision as of 15:53, 2 June 2023

Featured Article

To qualify for Section 321 release a shipment must not exceed 800 U.S. dollars in value and must not be one of several lots covered by a single order or contract, the value of which would exceed $800. CBP may also refuse to release a shipment as Section 321 when taking into account risk considerations that may vary for different classes or kinds of merchandise.

As of March 7, 2016 Section 321 informal entry limits increased from $200.00 USD to $800.00 USD.

On November 26, 2018 U.S. Customs and Border Protection began a phased approach for Section 321 non-compliance on ACE Manifests. Starting January 1, 2019 CBP will require an ACE Manifest for all Section 321 shipments. Failure to include Section 321 shipments on ACE Manifests may result in a monetary penalty starting at $5000 USD (for the first offence).[1]

Shipments released as Section 321 are free of duty and tax.